Capital raise summary

$1m

Raise size

$370k

Raised through Snowball Effect

23

Snowball Effect investors

3

Days on platform

Background

Snowball effect launched a private syndicated offer in July 2020 for BISON Group, a technology hardware company transforming the shipping industry. BISON Group had previously independently secured $630k towards a $1m equity round. As a result of the syndicated offer, BISON Group was able to fully fund its $1m equity round by securing an additional $370k on Snowball Effect’s platform.

Snowball Syndicated Raise

Snowball Effect’s Syndicated Raise Service was introduced to complement its traditional capital raising service and is available for companies that are seeking additional capital to close out a partially funded round.

The Syndicated Raise Service is aimed at wholesale investors and is intended to provide them with access to a wider variety of investment opportunities. Companies that are syndicating a raise with Snowball Effect will have funded a material portion of the round privately before making the offer available to Snowball Effect investors.

About BISON Group

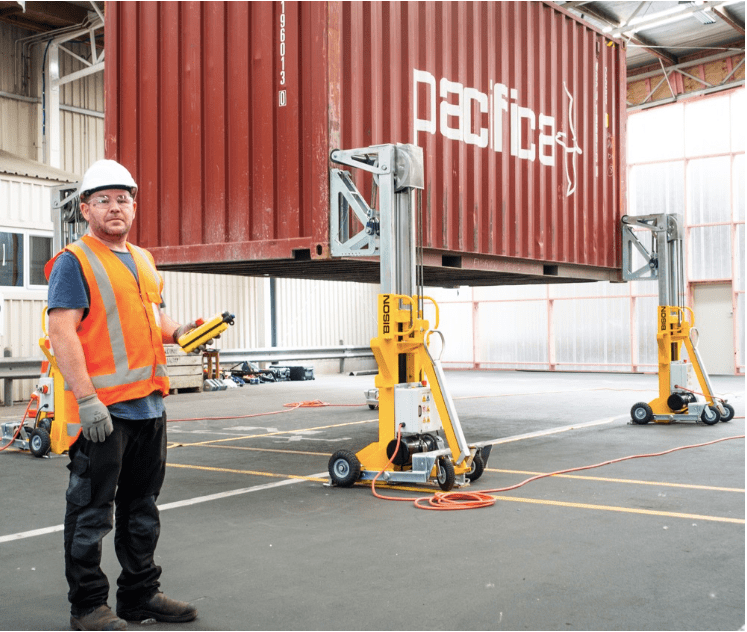

Launched in 2016, BISON is a technology hardware company that is transforming the way shipping containers are lifted and weighed.

BISON systems are a fraction of the cost, size and weight of traditional alternatives. This translates into cost savings and new logistics options for importers, exporters and military. The company has made sales in 60 countries and counts the likes of Siemens, Air Liquide, GE, NASA, and the US Army amongst its customer base.

The humble shipping container has had a transformative impact on global trade over the past 60 years. 182 million Twenty-foot Equivalent Units (TEU) of containerised cargo were moved in 2016 and analysts forecast this could grow to 858 million TEU over the next 4 decades. BISON has identified over 480,000 locations globally that their technology and hardware will solve container logistics issues.

BISON requirements

BISON was achieving strong growth and wanted to raise new equity to capitalise on the leadership position it had within the industry. New capital was to be spent on accelerating sales, marketing, lead generation, as well as product development.

Snowball Effect was engaged to assist BISON in closing out their existing capital raise, of which they already had secured $630k.

The Outcome

The syndicated capital raise was a success, with Snowball Effect and BISON both achieving the goals that were initially set. Snowball Effect raised the balance of the round ($370k) via its wholesale investor database.

The offer followed the following process:

-

Step 1

Snowball Effect reviewed the offer documentation that BISON had prepared and produced a high-level online ‘investment preview’ page, which included a short 5-minute pitch video by Greg Fahey (CEO, BISON). This page was distributed to Snowball Effect's database of more than 2,000 wholesale members to collect indications of interest.

-

Step 2

Investors had the opportunity to indicate interest, following which they were directed to the online offer page. The material and information available on the offer page were the same as, or updated versions of, the material supplied to investors that had already committed to the round. The offer page also provided access to additional legal documentation and company information.

Those seeking more detailed information were prompted to submit questions or contact BISON. Investors were also invited to attend a live webinar and Q&A session, although the webinar did not proceed as the offer was fully subscribed prior to the event.

-

Step 3

The offer attracted a lot of interest and was fully subscribed within 3 days.

Following the offer close, Snowball Effect conducted AML checks and processed investor payments through its platform. Funds were released to the company within 2 weeks of the offer closing.

-

Step 4

BISON signed up with Orchestra, a Snowball Effect related company and stakeholder management platform that helps companies manage its share register, investor communication, Company Office compliance and ESOP.

Orchestra continues to provide BISON with an easy way to manage its shareholders, as well as ensuring that investors have full visibility of their private company investments.

Snowball Effect’s Syndicated Service enabled BISON to close its capital raise efficiently, leaving it

sufficiently capitalised to execute its growth strategy and to continue transforming the way shipping

containers are lifted and weighed. BISON plans to conduct a Series A round in 2021.

Snowball Effect: Capital raising experts

Snowball Effect offers a wide range of services around capital raising that have helped companies of various different industries, backgrounds, and sizes. If you would like to know how we could help your company grow, please get in contact with our Director of Private Capital, Bill O’Boyle.